0

%

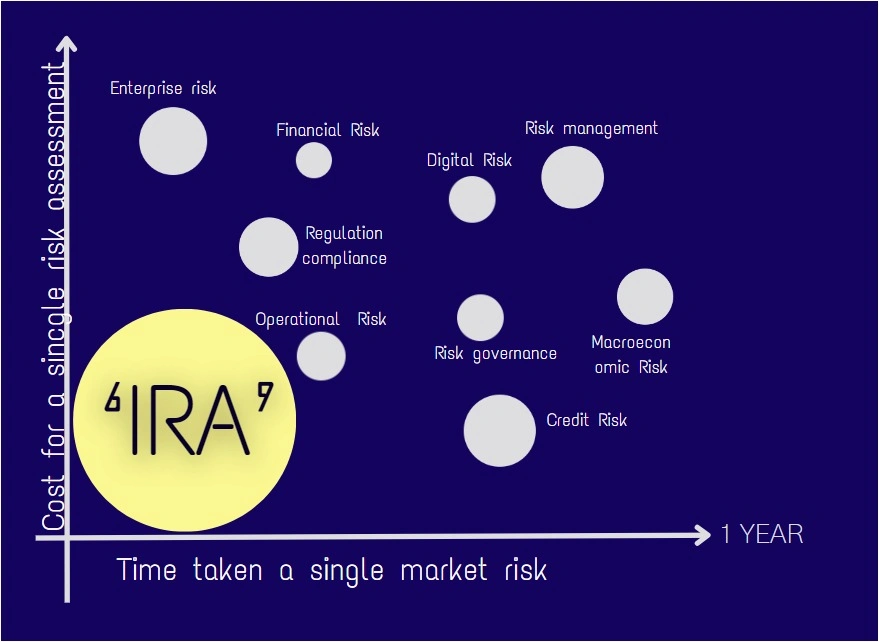

Global respondents cited poor ESG data and thus poor reporting.

0

%

Asset owners would prefer to receive standardized ESG reports.

0

%

European asset owner only receive standard reports.